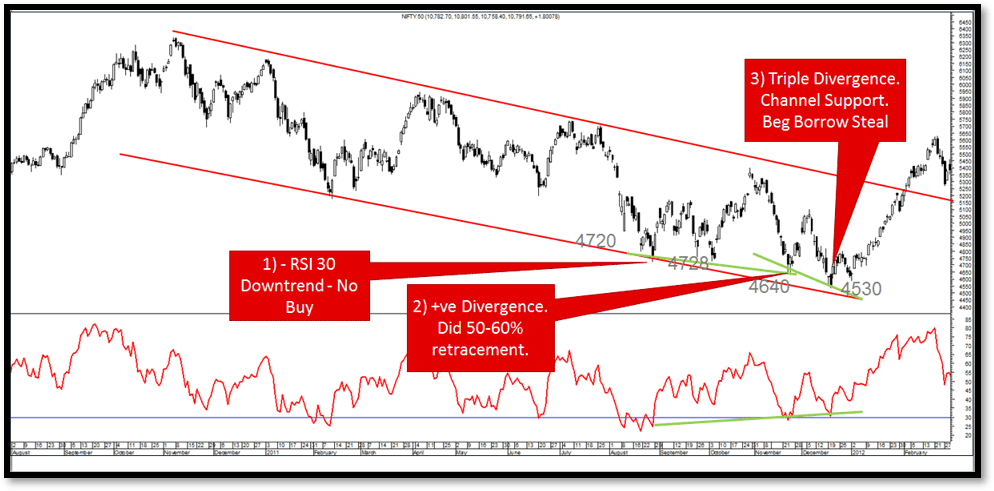

4 Great Tips For Choosing An RSI Divergence Strategy? Let's start with the most obvious question. Let's look into what RSI Divergence means and what trading clues it can give. If the price action and RSI indicators are not in sync, a Divergence is evident on the chart. The RSI indicator could make lower lows in downtrends, while the price action can make lower lows. Divergence occurs when the indicator is not in line with the price movement. When this happens it is crucial to watch the market. Based on the chart and the chart, both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are evident. However the price action has actually reversed following both RSI divergence signals. Now, let's talk about one final topic before moving to the topic that is exciting. View the most popular

rsi divergence cheat sheet for website recommendations including top 10 mt4 indicators, top 5 crypto trading platforms, most successful crypto traders, forex currency pairs list, safe crypto exchanges, pionex crypto, forex mobile, robinhood crypto california, ftc crypto, forex software, and more.

What Is The Best Way To Analyze The Rsi Divergence

What Is The Best Way To Analyze The Rsi Divergence We are using RSI to determine trend reversals. It is vital to determine the right one.

How Do You Recognize Rsi Divergence In Forex Trading Both Price Action (RSI indicator) and Price Action (Price Action) both did the same thing at the start of the trend. They both made higher highs. This signifies that the trend is stable. But, at the trend's arc it was evident that the price had higher highs, while the RSI indicator had lower highs. This is a sign that something should be watched on this chart. This is the reason why to pay focus on the market. The indicator as well as the price action are out-of-synchrony and this indicates the presence of an RSI divergence. The RSI divergence in this instance suggests a trend that is bearish. Look at this chart to find out what happened following the RSI divergence. It is evident that the RSI divergence is extremely precise in identifying trend reverses. The question now is how to spot the trend reverse. Let's examine four trade entry strategies that combine RSI divergence with higher probability signals. Take a look at most popular

backtesting for site advice including best time to trade us30, top forex brokers, soft4fx, regulated crypto exchanges, rsi diversion, coinbase pro auto trader, alpari forex broker, tradera trading, metatrader 5 algo trading, ai based automated trading platform, and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern Triangle chart pattern has two variations. One of them is the ascending triangle pattern that works as a reversal pattern in the downtrend. The descending Triangle pattern is used to reverse a market trend when it is in an upward trend. The forex chart below displays the descending Triangle pattern. As in the previous example the market was still in an upward trend, however the price began to fall. RSI may also be a sign of divergence. These indicators are indicative of the downfalls of this uptrend. Now we see that the speed of the current uptrend has decreased and the price ended with a downward triangular pattern. This confirms the reversal. The time is now for the short-term trade. Like the trade we did before we utilized the same breakout techniques for this trade. Let's now look at the third entry strategy to trade. This time, we'll mix trend structure and RSI diversgence. Let's look at how we can trade RSI diversion in the event that the structure of the trend is changing. Take a look at recommended

backtesting strategies for website examples including crypto day trading robinhood, virtual crypto trading, automated trading on binance, auto buy and sell crypto, forex capital, top 10 cryptocurrency trading platforms, metatrader 4 brokers list, forex expert, fx charts, thinkscript automated trading, and more.

Tip #2 – Combining the RSI Divergence Pattern with the Head & Shoulders Pattern RSI divergence helps forex traders to spot market reverses. So what if we combined RSI divergence with other reversal factors like the Head and shoulders pattern? We can boost the likelihood of our trades, which is fantastic to be sure, isn't it? Let's look at how to time trades using RSI divergence and the head-shoulders pattern. Related: Forex Head and Shoulders Pattern Trading Strategy - Reversal Trading Strategy. Before we think about a trade entry, we must be in a favorable market. Because we're looking for an inverse trend, it is preferential to have a market that is trending. Check out the chart below. Follow the best

backtesting trading strategies for blog tips including forex trading profit, best crypto for daily trading, xm spreads, one click trading mt4, stock market auto trading software, automated etf trading, wintermute crypto, hitbtc fees, automate binance trading, forex new, and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Tip #3 – Combining RSI Divergence with the Trend Structure The trend is our friend, surely! If the market is in a trend, then we should invest in the direction of that trend. This is what professionals tell us. The trend does not continue for a long time. It is likely to change. Let's examine trend structure, RSI Divergence and how to recognize reversals. We know that the upward trend is creating higher highs while the downtrend is forming lower lows. The chart below illustrates this point. The left-hand side of the chart shows a downtrend, with the series showing lows and highs. Next, let's take a look (Red Line) at the RSI divergence. The RSI creates higher lows while price action makes them. What is this implying? Despite the market generating low RSI, this means the momentum-loss trend is losing its momentum. Follow the best

backtesting strategies for website info including fully automated trading system, pionex crypto, volume indicator mt4, different crypto exchanges, nse auto trading, day trading crypto robinhood, forex funded account, free forex, coinrule strategies, fxopen bonus, and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom Double top, also known as double bottom, is a reversed pattern that is formed after an extended movement or following a trend. The double top forms when the price has reached a point that is not easily broken. When that level is reached, the price will drop a bit, but then rebound back to test the earlier level. If the price bounces back from that level, you will see a double top. Below is the double top. This double top illustrates that two tops were created after a strong maneuver. The second top was unable to rise above its predecessor. This is an obvious sign that a reversal is in the making because it means buyers are not able to move higher. Double bottoms employ the same techniques, but in a different way. We utilize the technique of breakout entry to trade. We execute selling when the price falls below the threshold. We took our profit after the price had fallen to below the trigger line. QUICK PROFIT. The same techniques for trading can be used for double bottom too. Below is a graph which explains how you can trade RSI diversgence with double top.

This isn't the ideal trading strategy. There isn't any one trading strategy that is perfect. Each trading strategy comes with losses. This trading strategy makes us steady profits, however we use strict risk management as well as a strategy to reduce our losses quickly. This helps us reduce drawdown, which opens the possibility of huge upside potential.