What Are The Strategies Used To Backtest In The Trading Of Cryptocurrency? Backtesting trading strategies for crypto trading is the process of simulated an investment strategy using historical data to assess the potential profit. These are some steps for back-testing a the crypto trading strategy: Historical data: You will require historical data sets that include volumes, prices, and other market data that is relevant to the situation.

Trading Strategy: Explain the trading strategy that is being tested. This includes entry and exit rules and position sizing.

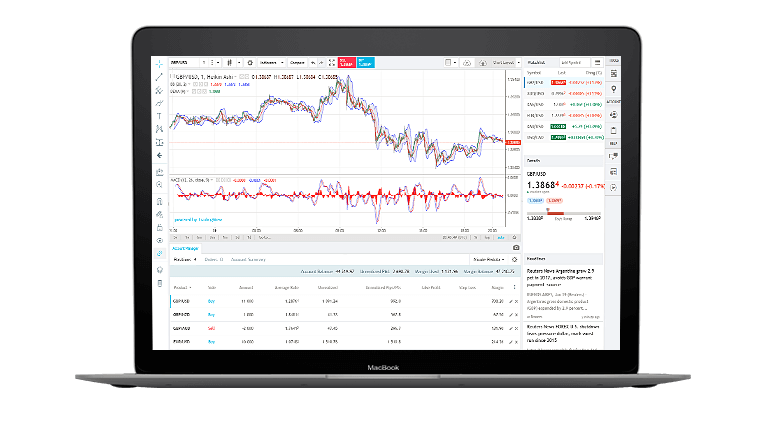

Simulation Software: Make use of software to simulate the execution of the trading strategy on the data from the past. This allows you to visualize how the strategy performed in the past.

Metrics: Examine the performance of the strategy using metrics such as profit, Sharpe ratio, drawdown, and any other measures that are relevant.

Optimization: Adjust the parameters of the strategy to maximize strategy performance.

Validation: Test the effectiveness of the strategy on out-of-sample data to ensure its reliability and to avoid overfitting.

It is crucial to keep in mind that past performance cannot be used to determine the likelihood of the future's performance. Backtesting results should not be used as a basis to predict future profits. Additionally, live trading demands that you consider the volatility of markets, transaction fees as well as other issues that are real-world. Check out the top rated

how you can help on automated trading platform for blog recommendations including top cryptocurrency trading platforms, bitsgap arbitrage, trading platforms for crypto, best crypto brokers, algo trading using amibroker, metatrader 5 automated trading, buy ripple on robinhood, coinbase pro automation, mql5 algo trading, exchange coins crypto, and more.

What Is The Best Way To Evaluate Forex Backtest Software When Trading With Divergence?

What Is The Best Way To Evaluate Forex Backtest Software When Trading With Divergence? If you are looking at backtesting software for the forex market, make sure it has access to the historical data which is accurate and high-quality for the forex pairs to be traded.

Flexibility: The software must permit the customization and testing of various RSI trading strategies that use divergence.

Metrics : The program should contain a variety of metrics to evaluate the performance of RSI Divergence Trading Strategies, such as drawdown, profitability, and risk/reward ratios.

Speed: The program should be quick and efficient. This will enable rapid backtesting of various strategies.

User-Friendliness: Even for people who have no technical knowledge the program should be easy to use and understand.

Cost: You must be aware of the cost of the program to determine if it is within your financial budget.

Support: You need an excellent customer service. This includes tutorials and technical assistance.

Integration: The program must work well with other trading tools like charting software or trading platforms.

It is recommended to test the software with an account on demo before you commit to paying for a subscription. This will make sure that the program meets your needs and that it is user-friendly. Follow the recommended

forex backtest software for website examples including best app to invest in cryptocurrency, qtrade crypto, best automated trading system, binance auto trade robot, olymp trade forum, automated crypto trading app, algo trading crypto, pionex fees, ttd stock forum, best stock market forums, and more.

What Exactly Is A Crypto Trading Backtester And How Do I Incorporate It Into My Trading Strategy?

What Exactly Is A Crypto Trading Backtester And How Do I Incorporate It Into My Trading Strategy? The cryptocurrency trading tester is a tool that lets traders compare their trading strategies with historical data on cryptocurrency prices. It can also be used to assess how the strategy performed in the present. This tool is useful for testing the effectiveness of a trading strategy.

You can select the backtesting platform. There's a broad selection of backtesting platforms available for crypto trading strategies like TradingView, Backtest Rookies and TradingSim. Select the one that is most suitable for your needs.

Set out your trading strategy. Before you can backtest it, you should establish the rules you'll apply to entering and exiting trades. This could include technical indicators like Bollinger Bands and moving averages.

It is now time to create the backtest. It is usually about selecting the cryptocurrency pair that you want to trade, the time frame you want to test, and any other parameters that are specific to your particular strategy.

When you have completed the backtest, you have set up the backtest, it is possible to run it to see how your strategy for trading would have been performing over time. Backtesters will produce reports that show the results of the trade, including profit and losses, loss/win ratios, and other metrics.

Examine the results You might want to adjust your plan based on results of the backtest to improve its performance.

Forward-test the Strategy: You can either test your strategy forward using the use of a demo account or with a small amount real money. For a better understanding of how it performs when trading is happening in real time.

You can get valuable insights from a backtester who tested crypto trading in order to evaluate the effectiveness of your plan. These lessons can be used to improve your trading strategy. Read the most popular

automated trading platform for site examples including etoro cryptocurrency, quantiply algo trading, binance selling fees, arbitrage crypto website, ftx exchange stock, crypto exchange rankings, automated forex trading reddit, best crypto platform, best robot trading software, crypto ai trading, and more.

What Are The Most Popular Cryptocurrency Trading Platforms That Support Automated Trading In Crypto?

What Are The Most Popular Cryptocurrency Trading Platforms That Support Automated Trading In Crypto? There are many platforms available to automate trading in crypto. Each has its own unique capabilities and capabilities. These are the best cryptocurrency trading platforms that support automated trading on crypto. 3Commas: 3Commas allows traders to create and execute automated trade bots on several cryptocurrency exchanges. It can be used for both short and long trading strategies and allows users to test bots back using historical data.

Cryptohopper: Cryptohopper is a cloud-based platform that allows traders to build and run trading bots for several cryptocurrencies on various exchanges. It offers a range of trading strategies that have been pre-built and an editor that lets you to create your own.

HaasOnline is a software that allows you to create and execute trading robots. HaasOnline is a no-cost software that allows traders create and execute automated trading robots that can be used for various cryptocurrency. It has advanced features, such as market making, backtesting, and arbitrage trades.

Gunbot: Gunbot, a download-able software that allows traders to build trading bots that can be used for multiple currencies across different exchanges. It provides a wide range of pre-built strategies and allows you to create customized strategies using a visual editor.

Quadency: Quadency, a cloud-based platform, allows traders to create and run automated trading bots on multiple cryptocurrencies across several exchanges. It offers a range of trading strategies as also tools to manage portfolios including backtesting, backtesting, and backtesting capabilities.

When choosing a crypto trading platform for automated trading, it's important to consider factors such as the supported exchanges, the trading methods offered and the user-friendliness of the platform, as well as the cost of using the platform. Make sure you try out any trading bots before you start using it for live trading. Check out the top

his response on crypto trading for more examples including best crypto exchange reddit 2021, best stock market message boards, auto trade oil, tastyworks automated trading, forex algo trading robot, binance margin trading, wunderbit tradingview, streak auto trading, trality trading, tradestation algo trading, and more.

What Do You Make Sure That An Automated Trading Program Reduce The Risk Of Loss?

What Do You Make Sure That An Automated Trading Program Reduce The Risk Of Loss? A well-designed automated trading system should have a risk-management system to minimize possible losses. This will help to limit potential losses, and stop the system from holding an unprofitable position.

Position Sizing. The trading system should have a function for sizing positions that calculates the proper size of trades according to the traders' tolerance to risk. This can minimize the possibility of losing money and ensure that the trades do not overflow the balance of the account.

Risk-to–Reward Ratio. The trading software must consider the risk-to–reward ratio for each trade and will only accept trades with positive risk-to-reward ratio. This means that the expected gain from a trade must be higher than the risk of loss, thereby reducing the risk of losing more money than gained.

Risk Limits. This is a set level of risk that the trading system is prepared to take. This could help in preventing the system from taking too much risk and suffering huge losses.

Backtesting and Optimization The automated trading system should be thoroughly backtested and optimized so that it is able to function well in different market conditions. This allows you to spot potential flaws and make adjustments to minimize losses.

A well-designed automated trading program includes a risk management strategy that includes the sizing of positions (stop-loss orders) Risk-to-reward rates, risk limits backtesting, optimization risk-to–reward ratios and risk limit. These tools can be utilized to reduce losses and optimize the efficiency of the trading system. Follow the best

automated trading platform recommendations for blog info including currency trading forum, supremefx trading system, mt4 ea forum, best app to buy crypto, coindcxpro, autotrading strategies, auto trading software for iq option, auto trade td ameritrade, best automated futures trading software, best place to trade cryptocurrency, and more.

[youtube]RDgu6d5dMGE[/youtube]