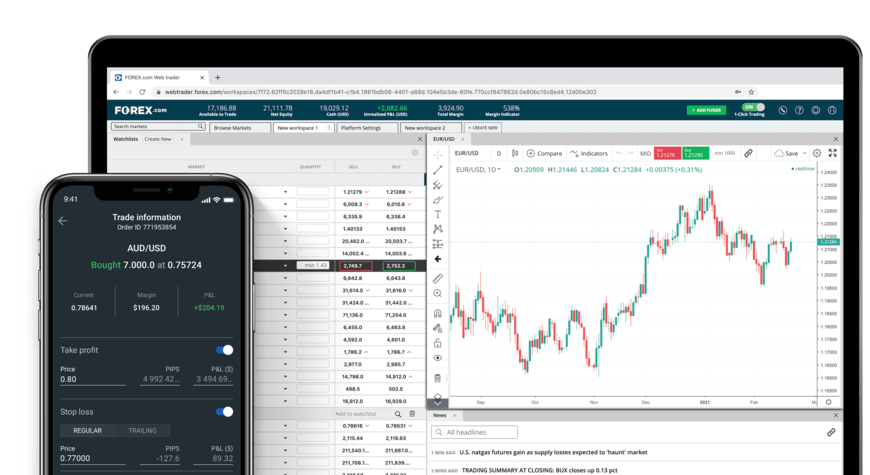

What Exactly Are The Advantages Of Automated Forex Trading And What Strategies And Tactics Are Recommended? Automated Forex Trading is the use of computer programs or trading algorithm to carry out trades in foreign market for exchange. These programs are programmed to follow specific rules for trading that aim to maximize profits and reduce loss.

Choose a trustworthy automated trading program There are a variety of automated trading software available in the market. You must choose an honest one with a proven track record and that can meet your requirements for trading.

Make a trading plan It is essential to establish a clearly defined strategy for trading prior to starting automated trading. This involves identifying the conditions that you would like to trade in, setting the entry and exit points, and creating a stop-loss order.

A risk management system is vital: Any trading system that's effective should include a method to limit the risk of losing money. This may include placing stop loss orders, and restricting the volume of trades at any given time.

Be sure to test your strategy prior to beginning trading. This will allow you to identify flaws in your strategy and make adjustments.

Automated Trading System Monitoring: While automated trading can save time, it is crucial to keep an eye on the system, and adjust it as needed.

Be aware of market conditions: If you want to be successful with automated Forex trading, you need to be aware of current market conditions and adapt your strategy accordingly.

A reliable combination of software and a well-defined trading strategy are crucial to the automation of Forex trading. Check out the most popular

trading with divergence for blog recommendations including auto buy sell indicator, live traders review reddit, cfd trader forum, online stock trading forum, automated swing trading software, coinbase pro automated trading, chat rooms for day traders, cryptocurrency exchange platform, coinrule best strategy, lowest crypto exchange fees, and more.

What Forex Backtesting Tools Are Available And How Best To Utilize Them?

What Forex Backtesting Tools Are Available And How Best To Utilize Them? There are many options for backtesting forex programs available. Each comes with its own capabilities and features. MetaTrader 4/5 and MetaTrader 5: MetaTrader, a popular platform for trading forex, comes with a built-in strategy tester for backtesting trading strategies. It gives traders the capability to test strategies using historical data, adjust settings and evaluate the results.

TradingView: It is an online charting and analysis platform, which also has a backtesting feature. It allows traders to test and create strategies with their Pine Script programming language.

Forex Tester is a stand-alone application that is able to test forex trading strategies. You can simulate different market conditions and test multiple strategies at the same time.

QuantConnect The cloud-based platform lets traders back-test strategies for trading forex by using a variety of programming languages like C#, Python, F#.

These steps will help you make the most of software for backtesting forex.

Define your trading strategy. Before you can backtest initiated, you need to define the rules and criteria for trading entry and exit. This could include indicators that are technical, chart patterns or other criteria.

Establish the backtest: Once your strategy has been defined, you can create the backtest in the software you prefer. This typically involves choosing the currency pair you want as well as setting the timeframe and any other specific parameters for your plan.

You can run the backtest after you've established it. This will allow you to evaluate how your strategy performed over time. The software that backtests generates reports that show the outcomes of the trades you made. It contains information such as the amount of profit and loss along with win/loss rates, as well as other indicators.

Analyze results: You can analyze the results following the test to find out how your strategy performed. The results of the backtest can help you modify your strategy and improve the effectiveness of your strategy.

Testing the strategy ahead of time: Once you've made any changes to your strategy you'll be able to forward test it with a demo account or with some real money. You'll have the ability to see how it performs under real-time trading situations.

By using forex backtesting software You can learn valuable information about how your strategy would have performed in the past, and then use the information to improve your trading strategy in the future. Check out the best

a replacement about rsi divergence cheat sheet for blog advice including automated stock screener, regulated crypto exchanges, forex spread betting forum, best stock and crypto app, buy crypto on etrade, auto buy and sell crypto, automated option trading software, etrade message board, forex auto signals, best crypto to trade, and more.

What Are All The Aspects To Consider When Analyzing Rsi Divergence?

What Are All The Aspects To Consider When Analyzing Rsi Divergence? Definition: RSI diversence is a instrument for analysis of technical aspects which compares the direction in which an asset's prices move with the index of relative strength (RSI). Types There are two types of RSI divergence: regular divergence and concealed divergence.

Regular Divergence: A situation that occurs when the price of the asset has a higher low/higher high and the RSI makes a smaller high/lower lowest. It could indicate a possible trend reversal, but it is essential to look at the other factors, both fundamental and technical, to confirm.

Hidden Divergence - If the value of an asset hits an lower or lower low, yet the RSI has a higher value or lower low, this is classified as hidden divergence. While this is less than regular divergence , it may still be indicative of potential trend reversal.

Be aware of technical issues:

Trend lines, support/resistance levels and trend lines

Volume levels

Moving averages

Other technical indicators and oscillators

Think about these basic aspects:

Releases of economic data

Special news for businesses

Market sentiment indicators

Global events and their effects on the markets

It is essential to consider both technical and fundamental factors prior to making investments based on RSI divergence signals.

Signal: A positive RSI Divergence could be read as a bullish sign. In contrast, a negative RSI Divergence could be seen as a bearish signal.

Trend Reversal: RSI Divergence can signal an inverse trend.

Confirmation: RSI Divergence should be utilized in conjunction with other analysis tools to serve as confirmation tools.

Timeframe: RSI divergence is possible to be observed over various times to gain different insights.

Overbought/Oversold RSI numbers that exceed 70 mean the overbought condition, while values lower than 30 indicate oversold.

Interpretation: To read RSI divergence properly, you need to consider other fundamental and technical factors. Check out the top rated

good about crypto trading for blog tips including best crypto buying app, bitfinex auto trader, options for crypto, world top crypto exchanges, kraken futures trading, algo trading programs, auto trading algorithm, td ameritrade crypto, gemini margin trading, auto trading, and more.

How Do You Analyze Backtesting Results In Order To Determine The Profitability And Risk Related Trading Strategies?

How Do You Analyze Backtesting Results In Order To Determine The Profitability And Risk Related Trading Strategies? Analyzing backtesting data is crucial in determining profitability and risk of a trading strategy. In order to analyse the backtesting results, you adhere to these steps to calculate the performance metrics. This is the first stage in analyzing results from backtesting. This involves the calculation of performance metrics like the total return, the average return and maximum drawdown. These metrics provide an insights into the effectiveness of the trading strategy as well as the risk.

Compare your performance to benchmarks. This allows you to examine the results of your trading strategy with benchmarks like S&P 500 or market indexes. It also gives an indicator of how it did in comparison to the broader market.

Assess risk management methods: Analyse the risk management strategies employed in the trading strategy, such as stop-loss orders or positioning sizing to determine their effectiveness in reducing loss.

Find trends: Examine the performance of the strategy over time to look for trends or patterns in terms of risk and profit. This can help you determine areas that could need to be adjusted.

Consider market conditions: Consider the market conditions in the backtesting phase, such as volatility or liquidity, and assess how the strategy performed in different market environments.

Backtest using different parameters to assess how the strategy performs in different situations.

Modify the strategy as required: Based upon the backtesting analysis results, modify the strategy to improve performance and reduce risk.

The analysis of backtesting results requires a thorough review of performance metrics , as well as strategies for managing risk and market conditions. These elements can have an impact on the efficiency and risk of a trading system. Professionals in trading can enhance their strategies by reviewing backtesting results. Read the top rated

from this source for crypto backtesting for more tips including trade crypto with leverage, etoro coinbase, best crypto exchange reddit 2021, binance trading automation, metatrader crypto, 3commas app, cfd trader forum, ticker message board, insider trading reddit, crypto exchange binance, and more.

How Do You Make The Most Effective Anaylse Trading With An Divergence Cheat Sheet

How Do You Make The Most Effective Anaylse Trading With An Divergence Cheat Sheet A RSI Divergence Cheat Sheet can be utilized to determine possible buy and sell signals that are based on the divergence between price and RSI indicator. The steps are: Understanding RSI divergence: RSI divergence refers to when an asset's price as well as its RSI indicator are moving in different direction. A bullish divergence occurs when the price is making lower lows while the RSI indicator is making higher lows. The bearish divergence happens when prices are making higher highs but the RSI indicator is making lower highs.

An RSI Divergence Cheat sheet is available. The cheat sheets are a great way to determine the signals to buy or sell that are based on RSI divergence. For instance the bullish divergence cheat sheet might suggest buying whenever the RSI indicator crosses above 30 and the price is at a higher level, while a bearish-looking divergence cheat sheet could suggest selling whenever the RSI indicator falls below 70, and the price is making a lower high.

Find possible signals for buying and selling An cheat sheet is a good way to spot potential buy and/or sell signals based on RSI divergence. The chart may have a bullish divergence signal. This could indicate that the asset is worth buying. On the other hand an indication of bearish could suggest that you should sell the asset.

Verify the Signal It is also possible to consider other indicators, such as moving averages or support-and resistance levels to confirm your signal.

Control Risk: RSI diversification trading can be risky. This could include placing stop loss orders to limit losses, or changing position sizes based upon risk tolerance.

Analyzing divergence trading with an RSI cheat sheet is identifying buy and sell signals based upon the divergence between price and RSI indicator. The signal is then verified using technical indicators or price action analysis. Before you use this strategy for live trading, it is important to understand the risks involved and thoroughly test it with historical data. See the recommended

he has a good point for more recommendations including crypto algo trading, best app to invest in cryptocurrency, margin lending ftx, most trusted crypto exchanges, autotrading systems global, stock market chat room, forex forum trading, best automated stock trading platform, tradesanta binance futures, etoro crypto leverage, and more.

[youtube]LnuBmAy80rY[/youtube]